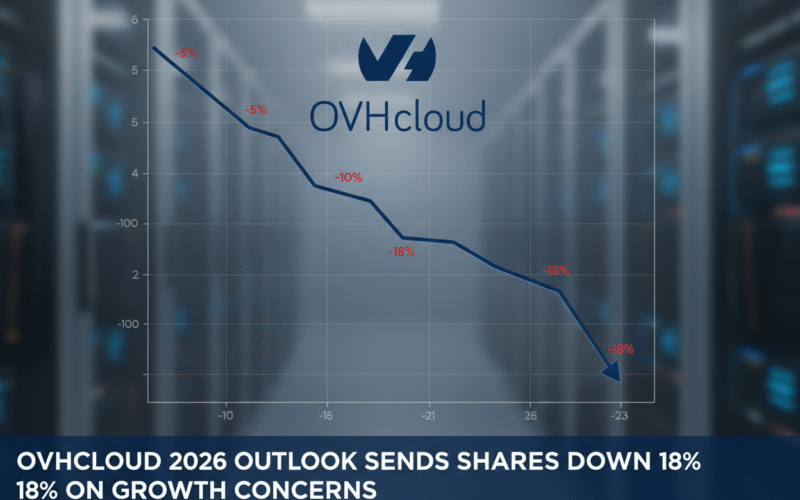

The OVHcloud 2026 outlook projects organic revenue growth between 5% and 7%, a significant decrease from the 9.3% growth recorded in fiscal year 2025. Analysts from Stifel and J.P. Morgan had anticipated a more optimistic forecast of approximately 10%, contributing to investor disappointment.

For fiscal year 2025, OVHcloud reported total revenues of 1.08 billion euros with an adjusted EBITDA margin of 40.4%, surpassing all guidance targets. The company also doubled its unlevered free cash flow from 25.1 million euros to 57.6 million euros, demonstrating improved operational efficiency.

The company aims to improve its core profit (EBIT) margin while projecting capital expenditures to range from 30% to 32% of overall revenue as it seeks to bolster its Webcloud division. This represents a notable increase from the 33.3% of revenue spent on Capex in fiscal 2025.

In a significant leadership change coinciding with the OVHcloud 2026 outlook announcement, founder Octave Klaba has returned as CEO effective immediately. The board decided to merge the chairman and CEO positions, with Klaba succeeding Benjamin Revcolevschi, who had served as CEO since 2024.

Klaba, whose family holds over 80% ownership stake in OVHcloud, previously led the company from its inception in 1999 until 2018 before transitioning to the chairman role. His return signals a strategic shift to align vision, strategy, and execution as the company responds to increasing demand for AI services.

The OVHcloud 2026 outlook comes at a critical time for cloud service providers navigating evolving market dynamics. The company faces growing demand for cloud independence amid geopolitical changes, while customers increasingly prioritize data sovereignty and competitive pricing models.

Earlier projections from OVHcloud’s 2024 Investor Day had set expectations for weighted average annual organic revenue growth between 11% and 13% for fiscal years 2024-2026, with adjusted EBITDA margin close to 39%. The revised guidance represents a notable downward adjustment from these targets.

Despite the disappointing OVHcloud 2026 outlook, the company achieved significant milestones in fiscal 2025. Net operating income (EBIT) reached 69.4 million euros, representing 6.4% of revenue, up from just 2.6% in fiscal 2024. The company also returned to positive consolidated net income of 0.4 million euros after posting a loss of 10.3 million euros the previous year.

OVHcloud’s growth has been driven by expansion across multiple segments and geographies. Public cloud revenue grew 17.2% year-over-year in the third quarter of fiscal 2025, while private cloud remained the leading offering. The company has been expanding its Local Zone offerings in the United States, now operating ten Local Zones across major cities.

The company continues developing its three-availability-zone regions for large corporations, with Milan targeted as the next location following Paris. OVHcloud is also investing in artificial intelligence solutions that respect customer data privacy and expanding data sovereignty certified products to address growing demand from public sector and healthcare verticals.

Octave Klaba, in his statement about the fiscal 2025 results, emphasized the company’s positioning for future growth despite the conservative OVHcloud 2026 outlook. The leadership change and strategic focus on cash generation reflect efforts to navigate an uncertain macroeconomic environment while capitalizing on digital transformation opportunities.

Stay updated on the latest cloud computing developments and leadership changes shaping the technology industry, visit ainewstoday.org for breaking news on market forecasts, strategic pivots, and innovations driving the future of cloud services and AI infrastructure!